Hudson Valley Weekend September 5-7

Homeowner Checklist for Fall 2014

Labor Day weekend is here and like many people in the Hudson Valley I can already sense fall in the air. Fall is my favorite time of year, it feels like a fresh start to me (residual feelings from when I was in school I suppose) and, after a very busy summer, is the perfect opportunity to get things back in order and organized.

For every homeowner, getting organized should also include a to-do list for the home and below you’ll find mine!

Hudson Valley Weekend August 21-24

Hudson Valley Weekend August 15-17

A new change in FICO scoring could make it easier to qualify for a mortgage

Your credit score is one of the main factors considered when qualifying for a mortgage. According to this article from Realtor Magazine, FICO, the nation’s most popular credit-scoring system is making changes to the way they calculate credit scores this fall and these changes could mean that you can now qualify for a mortgage.

One of the most important changes includes reducing the impact of past due medical bills on a person’s overall score. According to Nick Clements of Magnify Money (a personal finance site), an estimated 64 million Americans have medical collection items on their credit report. The reduction of the impact of medical debts could mean a raise of up to 25 points on a credit score for a person whose only delinquency comes from unpaid medical bills.

FICO is also removing penalties from consumers that have paid off past debts that were sent to a collection agency.

As of June 2014, the average FICO score for a closed mortgage was 728, which is down 14 points from last years average of 742. This is a good sign that lenders are loosening their lending standards, which means that more Americans can expect to qualify for a mortgage.

If you would like to discuss what type of mortgage you can qualify for, contact me at RitaM@kw.com!

Hudson Valley Weekend July 29 – August 3

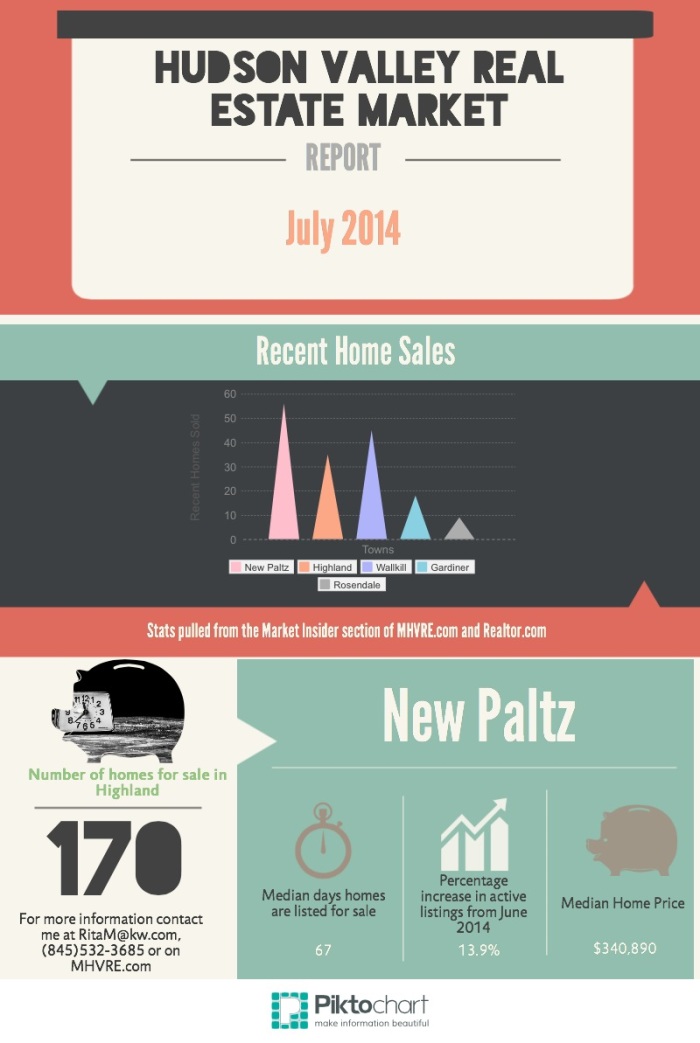

MHVRE July 2014

Home prices are on the rise, now is a great time to buy!

5 Must Know Tips for Buying a Home

Ready to buy a home? That’s great! But before you get the keys, there are some things you need to consider. To help you out, I’ve compiled the Top 5 things every home buyer needs to know (and do) to start the process.

1. Know your credit score: for most people buying a home is the largest investment they will make in their lifetime and more times than not it will require obtaining a mortgage. It is no secret that mortgage lenders have tightened their lending practices and it is important to know what your credit score is to make sure you will qualify for a mortgage at a rate that you are comfortable with.

2. Get pre approved for a mortgage: now that you have your credit score, the second step is getting a pre approval letter from your mortgage lender. With the housing market on the rebound mortgage rates are at an all time low, but they are expected to rise before years end so now is a great time to lock in at a desirable rate. Having a pre approval letter when making an offer on your dream home also makes you more marketable to sellers.

3. Understand all the costs and budget accordingly: in addition to your monthly mortgage payments you will be responsible for taxes and insurance. If you are buying your first home, it is important to remember you will be responsible for all upkeep on your house (snow plow in the winter, lawn care in the summer, garbage removal, etc.) and will be responsible for fixing or replacing anything that breaks on the home. A proper budget ensures that you are prepared if you run into unexpected costs down the line.

4. Hire a knowledgeable Real Estate Salesperson (that’s me!): As a real estate salesperson I am personally and professionally committed to getting results for my clients that put them in their dream home. Whether it be negotiating a purchase or selling a client’s home, I remain committed to keeping my clients informed every step of the way. When you are ready to begin the process contact me at RitaM@kw.com, I am available to my client’s 24/7 and remain committed to getting “Results that Move You” (yes, that is actually my slogan).

5. Research the area you want to live in: Once you are equipped with your pre approval letter, budget and ME it is time to start your home search. Searching for homes is made easy on MHVRE and one main advantage of my site is the Market Insider page, which allows you to obtain detailed information on any location by simply typing in the zip code. Information provided includes market statistics, school and community information and details on other homes for sale in the area.

To learn more about the home buying process contact me at RitaM@kw.com or visit MHVRE.